Weekly Market Commentary

March 31st, 2025

Week in Review…

Market indices closed the week lower as markets grappled with weakening consumer confidence and April 2 tariffs on automotives.

- The S&P 500 declined by -1.53%

- The Dow Jones Industrial Average declined by –0.96%

- The tech-heavy Nasdaq performed worst, falling –2.59%

- The 10-Year Treasury yield closed at 4.25%

Last week’s economic reports painted a complex picture, with persistent inflation concerns taking center stage. Specifically, core personal consumption expenditures (PCE), the Federal Reserve’s (Fed) favored inflation gauge, exceeded expectations at 0.4% month-over-month (versus 0.3%), signaling stubborn price pressures above the 2% target. Crucially, unlike the fixed-weight consumer price index (CPI), PCE adjusts for consumer behavior, making it a key Fed indicator. Further reinforcing inflation concerns, the University of Michigan revised its 1- and 3-year inflation expectations upward from already elevated levels. While the 7-year Treasury yield saw a slight increase, potentially reflecting these rising expectations, the 2- and 5-year yields declined, creating a mixed yield curve signal.

Shifting focus to consumer health, sentiment weakened noticeably. The Conference Board’s Consumer Confidence report fell short of expectations for the fifth consecutive month, albeit with potential for upward revisions. The University of Michigan’s sentiment index confirmed this trend, plunging 12% in February, with the expectations component dropping a precipitous 18% (and over 30% since November 2024). Personal spending also came in below forecasts (0.4% versus 0.5%), suggesting a potential pullback in consumer demand.

Meanwhile, business activity offered conflicting signals. Services Purchasing Managers’ Index (PMI) exceeded expectations, indicating strength in a crucial economic sector. However, manufacturing PMI disappointed. Countering this, durable goods orders provided a positive surprise, with core orders significantly exceeding expectations at 0.7% (versus 0.2%), offering some optimism for manufacturing. While manufacturing is smaller than services, its cyclical nature makes it a valuable economic indicator.

Markets are grappling with these mixed signals amidst a backdrop of tariff uncertainty. Investors will closely scrutinize upcoming data to determine the economy’s true trajectory and the persistence of inflationary pressures.

Spotlight

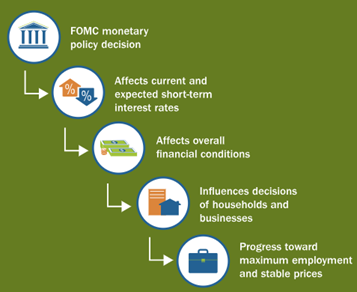

Federal Reserve Independence: Safeguarding Economic Stability and Inflation Control

When the Federal Reserve is no longer an independent party, it can have significant implications for the market. In practice, independence means that the Fed can set interest rates without interference from Congress or the White House, even if politicians are unhappy with Fed policy and say so publicly. This independence allows the Fed to make unpopular decisions, such as raising interest rates when necessary to maintain economic stability. If the Fed loses its independence, it may face political pressures to overstimulate the economy for short-term gains, leading to higher inflation and less stable economic conditions.

Research supports the case that economies with independent central banks tend to have lower and less volatile inflation rates. For example, the European Central Bank (ECB) was established with sufficient powers to prevent inflationary expectations from becoming embedded in the economy. This independence has allowed the ECB to make difficult but necessary monetary policy decisions in pursuit of stable prices. Furthermore, as stated in a research piece called Central Bank Independence and Macroeconomic Performance: Some Comparative Evidence, a positive relationship between the degree of independence of central banks and lower and less volatile inflation outcomes was found. This independence has contributed to a period of low macroeconomic volatility, known as the Great Moderation, where global labor supply and production capacity increased significantly, stabilizing prices and wages even in the face of strong demand. Additionally, according to Brookings, political interference in monetary policy can generate undesirable boom-bust cycles, ultimately leading to a less stable economy and higher inflation.

Flowchart of the Fed’s Mandates Impacting Individual Americans

Source: The Federal Reserve

(click image to expand)

Congress has given the Federal Reserve operational independence to ensure that monetary policy decisions are long-term, data-driven, and objectively analyzed to best serve all Americans. Despite this independence, the Fed remains accountable to Congress and the public through transparent communications. For instance, the Fed Chair testifies before congressional committees twice a year on economic developments and the Fed’s actions to promote maximum employment and stable prices. Ending the Fed’s independence could result in short-term bouts of inflation and deflation, but in the long run, prices might remain stable. However, massive borrowing could spark significant economic challenges. Investors and advisors must be aware of these risks and consider strategies that can adapt to the evolving market conditions.

Week Ahead…

The labor market will be a central theme this week, particularly following the Federal Reserve’s recent emphasis on its strength. Investors are keen to see if this trend continues, and several key reports will provide critical insights.

- Tuesday: The Bureau of Labor Statistics releases the February Job Openings and Labor Turnover Survey (JOLTS) report, offering detailed data on job openings, hires, and separations, which are essential for understanding labor market dynamics.

- Wednesday: The ADP Nonfarm Payroll report provides an early, though sometimes divergent, preview of the broader employment picture. Market reactions to this report may be subdued, however, as investors await Friday’s more comprehensive data.

- Friday: The market will digest a slew of major jobs reports, including Nonfarm Payrolls, Average Hourly Earnings, and the Unemployment Rate. The projected uptick in the unemployment rate to 4.2% will be closely watched, and any deviations could significantly impact market projections.

- Friday (later): Federal Reserve Chairman Jerome Powell’s speech will be intensely scrutinized for clues regarding future monetary policy.

In addition to the labor market data, several PMI reports will offer valuable insights into the broader economy:

- Monday: The Chicago PMI will be released, providing an early glimpse into regional manufacturing activity.

- Throughout the Week: S&P Global will finalize its March manufacturing and services PMI numbers, and the ISM Manufacturing and Services PMI will also be released.

- Key Focus: The ISM Prices component within these indices will be closely monitored as an indicator of inflationary pressures. This survey data will help markets better understand the overall direction of the economy.

Taken together, this week’s data releases and Fed commentary will provide a clearer picture of the economy’s current trajectory and inform market expectations for the months ahead.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.

Securities offered through Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, and investment advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Both are wholly-owned subsidiaries of Cambridge Investment Group, Inc. V.CIR.0325-1292