Weekly Market Commentary

September 22nd, 2025

Week in Review…

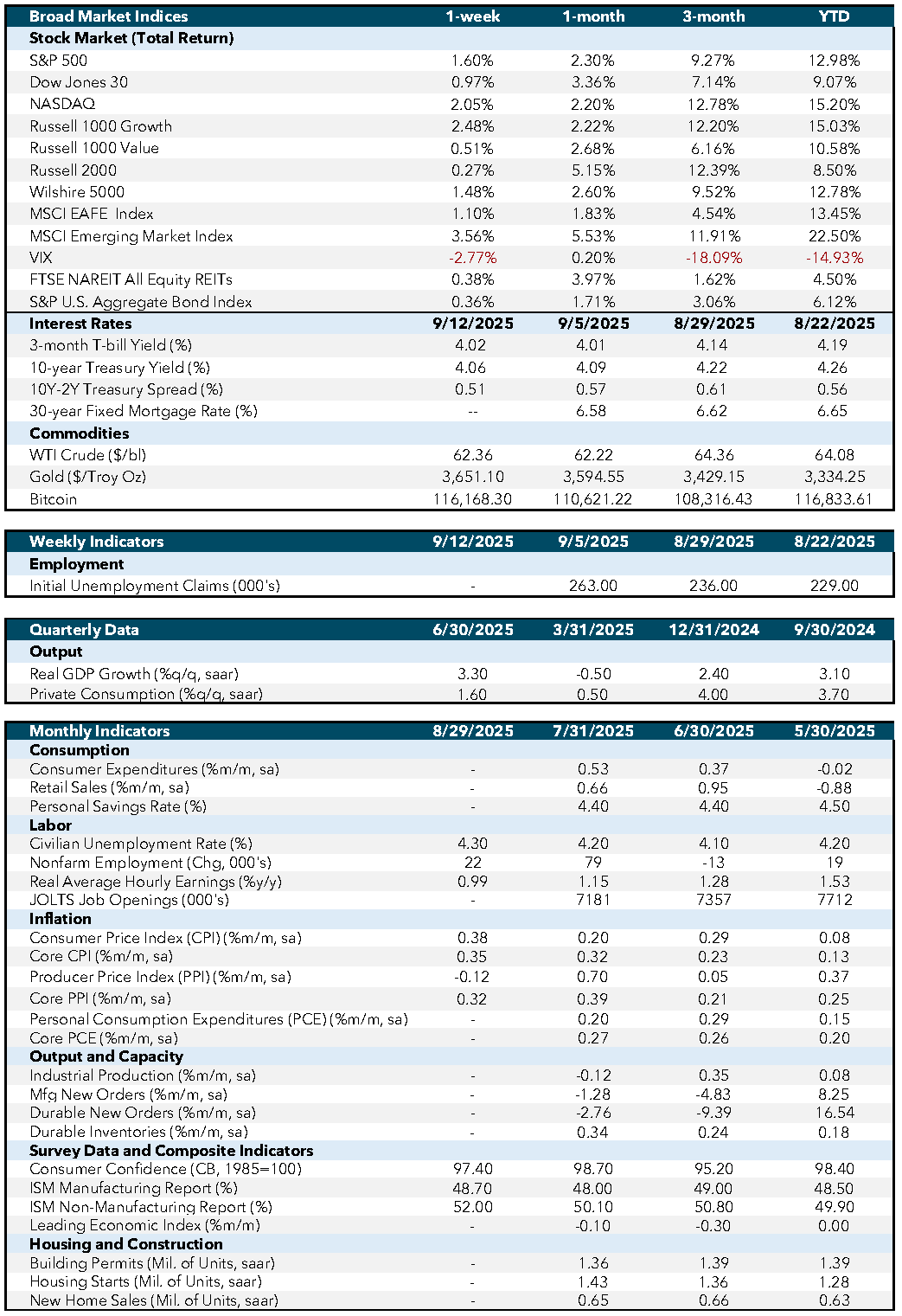

FOMC Decision and Inflation Outlook

The Federal Open Market Committee (FOMC) dominated headlines as the Fed cut its target rate by 25 bps, citing a softening labor market and downside risks. Chair Powell noted core personal consumption expenditure (PCE) inflation remains above the 2% target, with goods inflation picking up. While tariffs may create short-term inflation pressure, the Fed expects normalization over the medium to long term.

Retail Sales and Industrial Production

Retail sales surprised to the upside, with core (ex-autos) rising 0.7% vs. 0.4% expected, reinforcing the narrative of resilient consumer spending — a key driver of U.S. gross domestic product (GDP).

Industrial production also delivered a positive surprise. Output from manufacturers, quarries, and utilities rose 0.1% month-over-month (MoM), beating expectations of -0.1% and reversing the prior month’s -0.4% decline.

However, inventory data painted a more nuanced picture. Business inventories and retail inventories ex-auto both increased, signaling stockpiles are building at wholesale and retail levels. While this can sometimes point to softening demand, it may also reflect businesses preparing for future consumption. Investors will be watching closely to see which narrative prevails.

Housing Market Weakness

Wednesday brought disappointing housing data, with both building permits and housing starts coming in weaker than expected. Building permits, a forward-looking indicator, suggest softer future demand, while housing starts point to a market that may not be as resilient as hoped.

Quick Hitters

- Labor Market: Weekly jobless claims were a bright spot. Both continuing and initial claims came in below expectations, with continuing claims improving for five straight weeks and initial claims breaking a two-week losing streak

- Inflation Expectations: The 10-year TIPS yield fell to 1.734% from 1.985%, while the TIPS/Treasury breakeven held at 2.38%, signaling lower real rates even as long-term inflation expectations remain anchored

Week Ahead…

After a week dominated by the Fed’s rate cut and mixed economic signals, attention now turns to a packed slate of data that could influence growth expectations, inflation trends, and the market’s outlook for policy.

The week begins with S&P Global Manufacturing and Services Purchasing Managers’ Index (PMI), offering an early read on business sentiment across two critical sectors. These forward-looking indicators often shape expectations for future economic activity.

Housing will remain in focus after last week’s soft data. Investors will look for upward revisions to building permits and fresh insights from new home sales on Wednesday, followed by existing home sales on Thursday. Together, these reports provide a clearer picture of housing demand and consumer appetite for large purchases — a key gauge of economic resilience.

On Thursday, attention shifts to core durable goods orders, a proxy for business investment and confidence. Strong readings here would suggest firms remain willing to commit capital despite uncertainty.

The week concludes with the Fed’s preferred inflation measure: headline and core PCE. Markets expect a 0.2% MoM increase, down from 0.3% previously. Any upside surprise could complicate the rate-cut narrative. Later in the day, the University of Michigan will release updated inflation expectations and consumer sentiment, offering additional insight into the economic outlook and policy decisions.